How To Trade Forex?

Ready to master the art of Forex trading? Join us as we unveil the strategies, tools, and techniques to navigate the global currency markets successfully.

Currencies are exchanged around the clock throughout the globe. With an estimated $6 trillion in daily turnover, the Forex market generates immense opportunities for traders practically every hour of the week.

Thanks to technology, any trader can easily explore the lucrative opportunities available in the Forex market. However, where there is potential reward, there is also risk. This article provides a step-by-step guide to help you get started with your Forex trading journey in the right way. In addition, we’ll also present popular forex trading strategies and tips.

Open an account with an award-winning, regulated Forex broker for a world of trading opportunities!

Preparing for Your First Forex Trade

Trading Forex can be highly rewarding, but there are risks involved. Therefore, it is essential not to jump into the market without the proper knowledge. The better prepared a trader is, the greater their chances for success.

Key steps before you make your first trade in the Forex market:

Step 1: Learn About the Forex Market

The first logical step is to learn about the Forex market, including:

- Forex market structure

- Forex market participants

- Important terminology

- Factors that influence and move the market

- And more…

A solid grasp of the basics of Forex trading will help you understand the available risks and rewards, build your trading skills, and assist you in using essential trading tools and resources.

To get started on the basics of Forex trading, read our article: ‘What is Forex’.

Step 2: Choose How You Want to Trade Forex

Forex trading is all about buying and selling (exchanging) currencies. The most common Forex trading products retail traders use are spot Forex CFDs and FX options. With HubrisSpace, you have the choice of both CFDs and FX options.

Forex CFDs

A CFD (Contracts for Difference) is a derivative product that allows traders to speculate on the price changes of underlying Forex assets without actually owning them.

Learn more: What are CFDs?

FX Options

FX options are derivative contracts that give you the right (but not the obligation) to buy or sell a Forex contract at a specific price on a specified date.

Profits and losses in both CFDs and options depend on the size of the trade position and how far the price moves between the trade’s entry and exit points.

Step 3: Choose a Broker

A broker provides access to the Forex market. Every trader must make this decision with great consideration, as the broker is their trading partner.

Some of the factors to consider when selecting a Forex broker include:

- Regulation - The number of licenses and jurisdictions the broker is legally allowed to operate in, the safety of funds, transparent services, and other criteria.

- Trading Platforms – The types of trading platforms offered, reliability, tradable assets, automated strategies, cross-device functionality, ease of use, trading costs, and more.

- Trading Resources – The broker should supply you with an Economic Calendar, educational materials, a demo account, trading calculators, risk control tools, and more.

- Payment Methods – There must be safe and convenient payment options, quick deposits, and, most importantly, hassle-free withdrawals.

- Customer Service – The broker should be professional and responsive and provide exceptional support.

HubrisSpace boasts all of the above features and more. We are your trusted brokerage partner and are as committed to your trading growth and success as you are!

Step 4: Open a Trading Account

After choosing a broker, you should open a trading account to be able to trade currency pairs. Be sure to check what account options are offered and select the one that is appropriate for your needs.

For all traders, especially beginners, it is advisable to start with a demo account to practice trading risk-free. When you are ready to trade for real profits, you can switch to your real money trading account.

Open a Demo account to practice what you've learned or a Real account to start trading today!

Step 5: Prepare a Trading Plan

A trading plan is a clear and detailed plan of how you intend to trade. It helps you stay the course by sticking to clearly defined goals and not just randomly trading. A trading plan details aspects such as your:

- Trading strategy

- Trading goals and ambitions

- Risk management

- Trading log

- Overall trading rules

- Trading psychology

A trading plan will help you make trading decisions efficiently and build the trading discipline required to achieve consistent success in the Forex market.

Step 6: Choose a Forex Pair to Trade

In the Forex market, you can trade numerous currency pairs that fall into broad categories of majors, minors, and exotics.

Currency pairs differ in liquidity and volatility, which consequently impacts their spreads and overall risk exposure.

For beginners, it is preferable to choose a currency pair that is highly liquid and has low spreads. In general, all the major pairs (containing USD) meet these criteria, plus they have extensive media coverage so that there is readily available information to help you make quality and comprehensive analyses.

Some of the most popular Forex pairs you can trade with HubrisSpace include EURUSD, GBPUSD, USDJPY, USDCHF, and many more…

Step 7: Analyse the Market

When trading Forex, your profits or losses will be determined by your entry and exit prices in the market. You must analyse your preferred forex pairs to identify the best opportunities in the market and the optimal price points to take advantage of the prevailing market conditions.

Traders utilize three analysis types in the Forex market:

- Technical Analysis - Utilizes formations on price charts, graphical objects, and mathematical functions to predict future price dynamics.

- Fundamental Analysis - Relies on assessing economic factors affecting the asset's price to determine its fair market value.

- Sentimental Analysis - This is based on examining prevalent market sentiment expressed in open Buy/Sell positions and in COT (Commitment of Traders) reports.

Ideally, every trader should have a solid understanding of all types of analysis. Using more than one type of analysis can help reveal new opportunities and reduce the limitations of a single method. With experience, you will customize a strategy to suit your personality and risk appetite.

Step 8: Buy or Sell

After completing your analysis of the chosen currency pair, you will be able to decide whether to buy or sell.

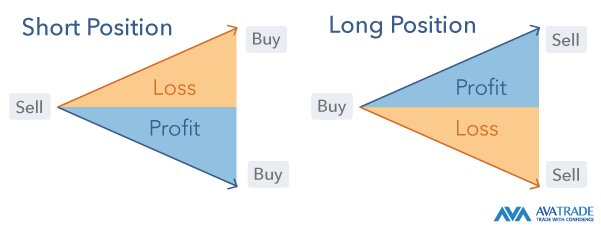

In Forex, you buy (go long) when you expect the price of an underlying asset to rise. Similarly, you sell (go short) when you expect the price of an underlying asset to fall.

For instance, while doing analysis, you identify a signal to buy the EURUSD pair, which can be triggered when the price falls to a support area. If the current price is 1.0750 and falling, a trader may wait to buy at 1.0700 in anticipation that the price will be unable to breach that support area.

Alternatively, the trader may also consider the price of 1.0800 as a strong resistance area and look to sell EURUSD if it climbs to that level.

Step 9: Risk Management

Forex is a market full of opportunities, but risks are also present. To have a chance at achieving and sustaining success, you must have a solid risk management plan.

Risk management enhances your longevity in the Forex market, giving you the best chance to realise long-term trading success.

Some of the risks that traders are exposed to in the markets include:

- volatility risk

- liquidity risk

- leverage risk

- market risk

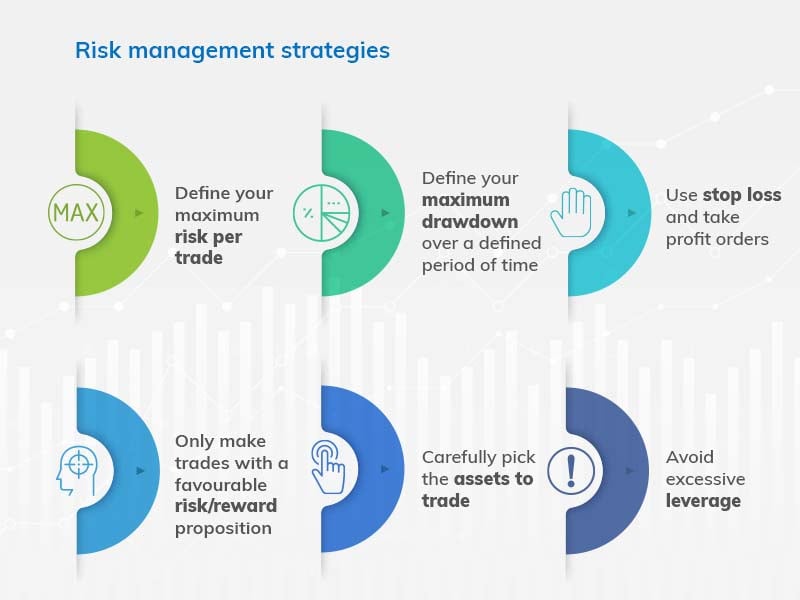

Here are some strategies you can use to manage these risks:

- Define your maximum risk per trade

- Define your maximum drawdown over a defined period of time

- Use stop loss and take profit orders

- Only make trades with a favourable risk/reward proposition

- Carefully pick the assets to trade

- Avoid excessive leverage

Step 10: Monitor Your Positions

The Forex market is highly dynamic and volatile, which presents many opportunities and risks. This is why it is so important to actively monitor your trade positions to ensure they are in tandem with the prevailing market situation.

Remember to monitor your positions, as a good trade can quickly turn bad and vice versa. Keeping your finger on the pulse will help you to minimize losses and boost trading profits.

Some strategies to adequately monitor your trade position include:

- Tracking emerging news and events using the Economic Calendar

- Setting up trading alerts on your platform

- Subscribing to trading signals

- Following top traders and others through social media

- Take advantage of monitoring and reporting features available through the trading platform and apps

Step 11: Close Your Trade

After opening and monitoring a position, the next vital decision is when to close it. Closing your trade is what determines whether you earn a profit or incur a loss.

A good exit strategy will ensure that you do not maintain unnecessary risk exposure in the markets and do not leave good profits on the table.

You can close your trade when:

- It hits the stop loss or take profit levels that you defined

- A trading session/week has ended and there will be unforeseen risks in the new session/week

- You need to avoid a margin call

- A new lucrative opportunity has arisen, and you want to free up capital

- The market situation has changed, and your initial analysis is no longer valid