How to Trade CFDs?

Embark on a journey to become a confident CFD trader.

Explore our step-by-step guide to mastering these versatile

financial instruments and achieving your trading goals.

Welcome to the exciting world of CFD trading! Assuming you're already familiar with Contracts for Difference (CFDs), we will explore how to trade them effectively. If you're new to CFDs or need a refresher, we recommend checking out our article on "What are CFDs" to understand this type of financial instrument. Now, let's dive into the mechanics of trading CFDs and discover the steps involved in executing successful trades.

Feel you are ready to start your trading journey?

Open a trading account or practice on a free demo account today!

How to Start CFD Trading

If you're ready to embark on your CFD trading journey, follow this step-by-step guide to get started:

1. Choosing a CFD Broker

The first step is to select a reputable CFD broker to open an account with. As you explore your options, consider HubrisSpace, a leading CFD broker with many unique advantages. As an award-winning, regulated broker, HubrisSpace offers user-friendly trading platforms, access to hundreds of tradeable assets, and comprehensive educational resources to empower traders of all levels.

2. Opening and Funding a Trading Account

Once you have chosen your preferred CFD broker, the next step is to open a trading account and fund it with your starting capital. At HubrisSpace, we support multiple safe and convenient payment methods such as Debit/Credit cards, bank transfers, as well as several eWallets.

Open a Demo account to practice what you've learned or a Real account to start trading today!

3. Choosing a CFD Market

HubrisSpace offers a diverse range of instruments to trade as CFDs. Whether you're interested in forex, stocks, indices, commodities, or cryptocurrencies, HubrisSpace has you covered. Be sure to conduct thorough market research and utilize HubrisSpace's educational resources, plus employ technical and fundamental analysis to make informed decisions about which market suits your trading strategy and objectives.

4. Develop a Trading Plan

Before you start trading, it's essential to have a well-defined trading plan in place. This should include your trading goals, risk tolerance, and trading strategies. A trading plan acts as a roadmap to guide your decisions and keep you focused.

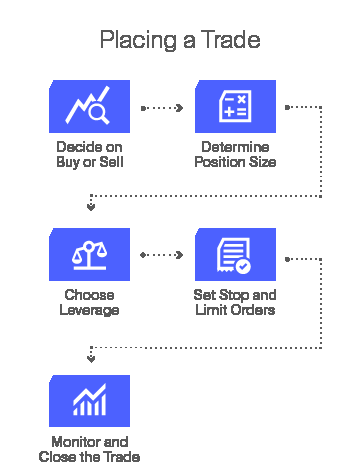

5. Placing a Trade

Now that you have an account and have chosen a market, let's explore the steps involved in placing a CFD trade:

- Buy or Sell: Determine whether you want to enter a buy position (go long) or sell position (go short) based on your market analysis and trading strategy.

- Determine Position Size: Establish how much you wish to trade in a single position, considering your risk tolerance and available capital. HubrisSpace provides flexible position sizing options to accommodate various trading styles.

- Choose Leverage: Assess the appropriate level of leverage based on your risk appetite and trading plan. HubrisSpace offers competitive leverage options, allowing you to amplify your trading potential. However, remember to use leverage responsibly and understand the associated risks.

- Set Stop and Limit Orders: Implement risk management measures by setting stop-loss and take-profit orders. Stops limit losses of your trading capital if prices go against you, whereas take profit orders lock in profits when your price predictions are right. These orders execute automatically, so you do not have to constantly watch your open trade positions.

- Monitor and Close the Trade: Stay vigilant and monitor your trade as market conditions evolve. Adjust if necessary and manually close the trade when you're ready to realize your profits or limit your losses.

By following these steps with HubrisSpace, you can start trading CFDs backed by a reputable broker that provides competitive advantages and a supportive trading environment.

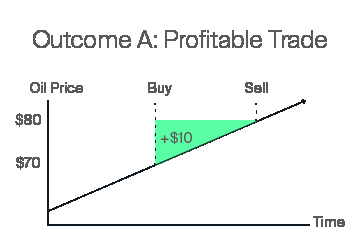

CFD Trade Example: Long Position on Crude Oil

Let's explore a theoretical CFD trade on Crude Oil, where we will consider two possible outcomes: a profitable trade (Outcome A) and a losing trade (Outcome B). In this example, we will assume an entry price of $70 per barrel for both scenarios, with a 100-barrel lot (a lot is a standardized number of units).

Outcome A: Profitable Trade

You enter a long position on Crude Oil at $70 per barrel, using a 100-barrel lot. Shortly after opening the trade, news breaks about an OPEC meeting where member countries announce production cuts to stabilise the global oil supply. This fundamental factor leads to increased demand expectations, causing the price of Crude Oil to surge.

Over the following days, the price of Crude Oil steadily climbs to $80 per barrel. Recognising the positive momentum, you decide to close your position, capitalizing on the profit potential.

Calculating the profit: Profit per barrel = Closing price - Opening price = $80 - $70 = $10

Total profit = Profit per barrel × Number of barrels = $10 × 100 = $1,000

Outcome B: Losing Trade

In another scenario, unexpected geopolitical tensions arise in a major oil-consuming region, leading to concerns about disruptions in the oil demand. Additionally, economic data shows a slowdown in global economic growth, indicating a potential decrease in oil demand.

As a result of these fundamental factors, the price of Crude Oil experiences a sharp decline. The price per barrel drops to $60, leading to a loss on your long position. Concerned about further potential losses, you decide to close the position to mitigate the risk.

Calculating the loss: Loss per barrel = Opening price - Closing price = $70 - $60 = $10

Total loss = Loss per barrel × Number of barrels = $10 × 100 = $1,000

CFD Trading Tips for Beginners and Experienced Traders

- Master the Basics: Before you begin trading CFDs, ensure you have a clear understanding of what they are and how they work.

- Start with a Demo Account: It's advisable to start with a demo account, especially if you're new to CFD trading. This will give you an opportunity to familiarize yourself with the market and the mechanics of CFD trading without risking real money.

- Manage Leverage Wisely:CFD trading involves leverage, which means you can trade a larger position with a smaller amount of capital. While this can increase potential returns, it's important to use leverage responsibly and be aware that it also amplifies risks. Always manage your leverage effectively to avoid significant losses.

- Diversify Your Portfolio: CFD brokers like HubrisSpace offer access to a wide range of assets. Take advantage of this by diversifying your exposure across different asset classes. This can reduce dependence on a single asset and potentially enhance risk management.

- Stay Informed: Stay updated with market news and trends to make informed trading decisions. Being aware of current events and market developments can provide valuable insights and help you anticipate potential market movements.

- Manage Risks: Use risk management tools, such as stop-loss orders, to limit potential losses. Never invest more than you can afford to lose, and always consider the potential risks involved in each trade. HubrisSpace offers a unique risk management solution – AvaProtect.

- Keep Learning: The financial markets are constantly evolving, and there is always something new to learn. Continuously educate yourself about trading strategies, market analysis techniques, and risk management practices. By expanding your knowledge, you can adapt to changing market conditions and improve your trading skills.

- Understand the Costs: Be aware of the costs associated with CFD trading, including overnight financing and spreads. Consider these costs because they directly impact your potential profits.

Why Trade CFDs with HubrisSpace

At HubrisSpace, we provide a range of unique features and advantages that set us apart as a preferred choice for CFD trading. When you choose HubrisSpace, you benefit from:

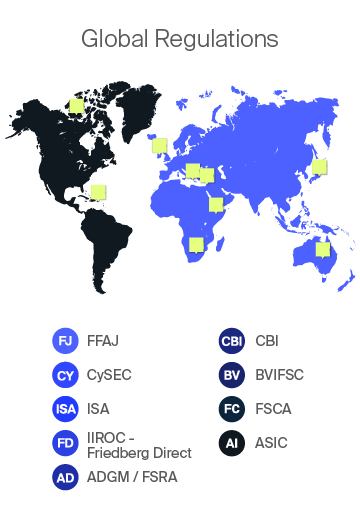

- Regulated and Secure Trading Environment: Trade with complete peace of mind, knowing that HubrisSpace operates within a secure and regulated trading environment. We are licensed and regulated by multiple international financial authorities, guaranteeing the safety of your funds and personal information.

- Comprehensive Education Centre:Gain access to a wealth of educational resources, including webinars, articles, and video tutorials, designed to empower you with the knowledge and skills to navigate the financial markets successfully.

- User-Friendly Trading Platforms: Experience our powerful and intuitive trading platforms, including MetaTrader 4, MetaTrader 5, WebTrader, and our mobile HubrisSpaceApp. Enjoy advanced trading tools and features, seamless execution, and real-time market analysis.

- Risk-Free Demo Account: Start your trading journey with our risk-free demo account. Practice trading strategies, familiarize yourself with the platform, and build confidence without risking real money.

- Dedicated Customer Support:Our multilingual customer support team is available to assist you with any inquiries or technical issues you may encounter. We're here to ensure you have a smooth and enjoyable trading experience.

- Unique Trading Resources: Access exclusive trading resources, such as Trading Central's comprehensive market analysis, and AvaProtect, which allows you to protect trades against potential losses for a defined period.

Start Your CFD Trading Journey with HubrisSpace

If you're ready to embark on your CFD trading journey, we invite you to open a risk-free demo account with HubrisSpace. Practice your strategies, explore our educational materials, and get a feel for our user-friendly platforms. Alternatively, open a real-money trading account and experience the full range of benefits HubrisSpace has to offer.

Begin your trading activity backed by a reputable broker that prioritizes your success and provides exceptional customer support.

Join HubrisSpace today and unlock the potential of CFD trading.

How to Trade CFDs - FAQ

CFD trading offers several advantages, including the ability to trade on both rising and falling markets, access to a wide range of instruments, leveraged trading, and the flexibility to implement practically any strategy. With HubrisSpace, you can appreciate these benefits while enjoying a user-friendly trading platform and comprehensive educational resources to enhance your trading experience.

To start trading CFDs, you'll need to choose a reputable CFD broker like HubrisSpace, open a trading account, and fund it with your desired starting capital. Select the CFD market you want to trade, decide whether to go long (buy) or go short (sell) based on your market analysis, determine your position size, set appropriate risk management measures (stop-loss and take profit), and monitor your trades. HubrisSpace provides the tools, educational resources, and customer support to help you navigate the process effectively.

While CFD trading offers opportunities, it's important to know the risks involved. CFD traders are exposed to risks such as leverage risk and price volatility. Some of the ways you can manage these risks include having a trading plan, understanding the markets you are trading, using stop-loss and take-profit orders, as well as monitoring the Economic Calendar. You can also use the exclusive HubrisSpace’s Protect tool to insure your open positions against losses for a particular time period.

Improving your CFD trading skills requires a commitment to continuous learning and practice. HubrisSpace offers comprehensive financial education resources to enhance your knowledge, including webinars, articles, and video tutorials. You can also use HubrisSpaceSocial to connect with the best-performing traders on our platforms and learn from their trade selections. Stay informed about market news and trends, adapt your trading strategies to changing conditions, and develop a well-defined trading plan. An HubrisSpace demo account provides a risk-free environment to practice and refine your trading strategies whether you are a new or experienced trader.

HubrisSpace stands out as a leading CFD broker due to its comprehensive financial education resources, user-friendly trading platforms, dedicated customer support, and commitment to a secure and regulated trading environment. With HubrisSpace, you can access a wide range of tradeable instruments, utilize innovative trading tools, and benefit from unique features like Trading Central market analysis and for risk management. Whether you're a beginner or an experienced trader, HubrisSpace provides the support and resources you need for successful CFD trading.